how much does colorado tax paychecks

And if youre in the construction business unemployment taxes are especially complicated. Therefore FICA can range between 153 and 162.

Colorado Paycheck Calculator Adp

Fast easy accurate payroll and tax so you save time and money.

. Interactive Tax Map Unlimited Use. Unlike some other states Colorado does not currently have any sales tax holidays. The Colorado bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Supports hourly salary income and multiple pay frequencies. So how much is the employer cost of payroll taxes. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Select a tax type below to view the available payment options. How do I calculate payroll taxes manually. This free easy to use payroll calculator will calculate your take home pay.

Colorado Paycheck Calculator Adp. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Each tax type has specific requirements regarding how you are able to pay your tax liability. Social Security has a wage base limit which for 2022 is 147000. Ad Does Tax Season Stress You Out.

Every employer must prepare a W-2 for. For annual and hourly wages. Payroll benefits and everything else.

Ad Lookup Sales Tax Rates For Free. Colorado Salary Paycheck Calculator. There are eight other states with a flat income tax.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. How much does colorado tax paychecks Wednesday May 25 2022 Edit This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Automatic deductions and filings direct deposits W-2s and 1099s. Gusto offers fully integrated online HR services.

There is no income limit on Medicare taxes. The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. Calculate your tax year 2022 take home pay after federal Colorado taxes deductions and exemptions.

Dont Fear the IRS Get Help With Your 2022 Taxes Today. Tax year Filing status Taxable income Rate. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

For 2022 the Unemployment Insurance tax range is from 075 to 1039 with new employers generally starting at 17. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. You need to fill out a new W-4 whenever you start a new job but you can also fill one out at any time.

It changes on a yearly basis and is dependent on many things including wage and industry. Best Company Can Help You Find Top-Rated Tax Services Now. 124 to cover Social Security and 29 to cover Medicare.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents. To use our Colorado Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Why Gusto Payroll and more Payroll.

Employers are required to file returns and remit tax on a quarterly monthly or weekly basis depending on the employers total annual Colorado wage withholding liability. How You Can Affect Your Colorado Paycheck. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. That 463 applies to Colorado taxable income which is equal to federal taxable income.

Colorado state sales tax. The gasoline tax of 22 cents. Colorado has no state-level payroll tax.

Colorado income tax rate. Excise Fuel Tax. Switch to Colorado hourly calculator.

Census Bureau Number of cities that have local income taxes. For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575. For 2021 tax rates for experienced employers range from 071 to 964.

If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. What is the Colorado unemployment tax rate. Sales Use Tax.

Tax rates are to range from 075 to 441 for positive-rated employers and from 568 to 1039 for negative-rated employers. Refer to Tax Foundation for more details. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145.

This 153 federal tax is made up of two parts. For employees earning more than 200000 the Medicare tax rate goes up by an additional 09. Colorado imposes a 290 sales tax with localities charging 475 for 765 percent.

Colorado Paycheck Quick Facts. The state levies various taxes on various items. Colorado Unemployment Insurance is complex.

Payroll benefits and everything else.

Colorado Paycheck Calculator Adp

2022 State Tax Reform State Tax Relief Rebate Checks

Opt Student Taxes Explained Filing Taxes On Opt 2022

Colorado Paycheck Calculator Adp

![]()

Colorado Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Or See Exactly How Much You Paid For Each Category With Your Personal Tax Receipt Here Https Www Nationalpriorities Org Interactive D Tax Day Tax Income Tax

Tax Documents And Deadlines University Of Colorado

Free Colorado Payroll Calculator 2022 Co Tax Rates Onpay

Colorado Income Tax Calculator 2021 2022

Colorado Taxpayers Could See 750 Refund Checks This Summer New Forecast Estimates Colorado Newsline

1 200 After Tax Us Breakdown July 2022 Incomeaftertax Com

Plan A Christmas Vacation Math Project And For Use With Google Classroom Math Projects Christmas Math Activities Math Activities Elementary

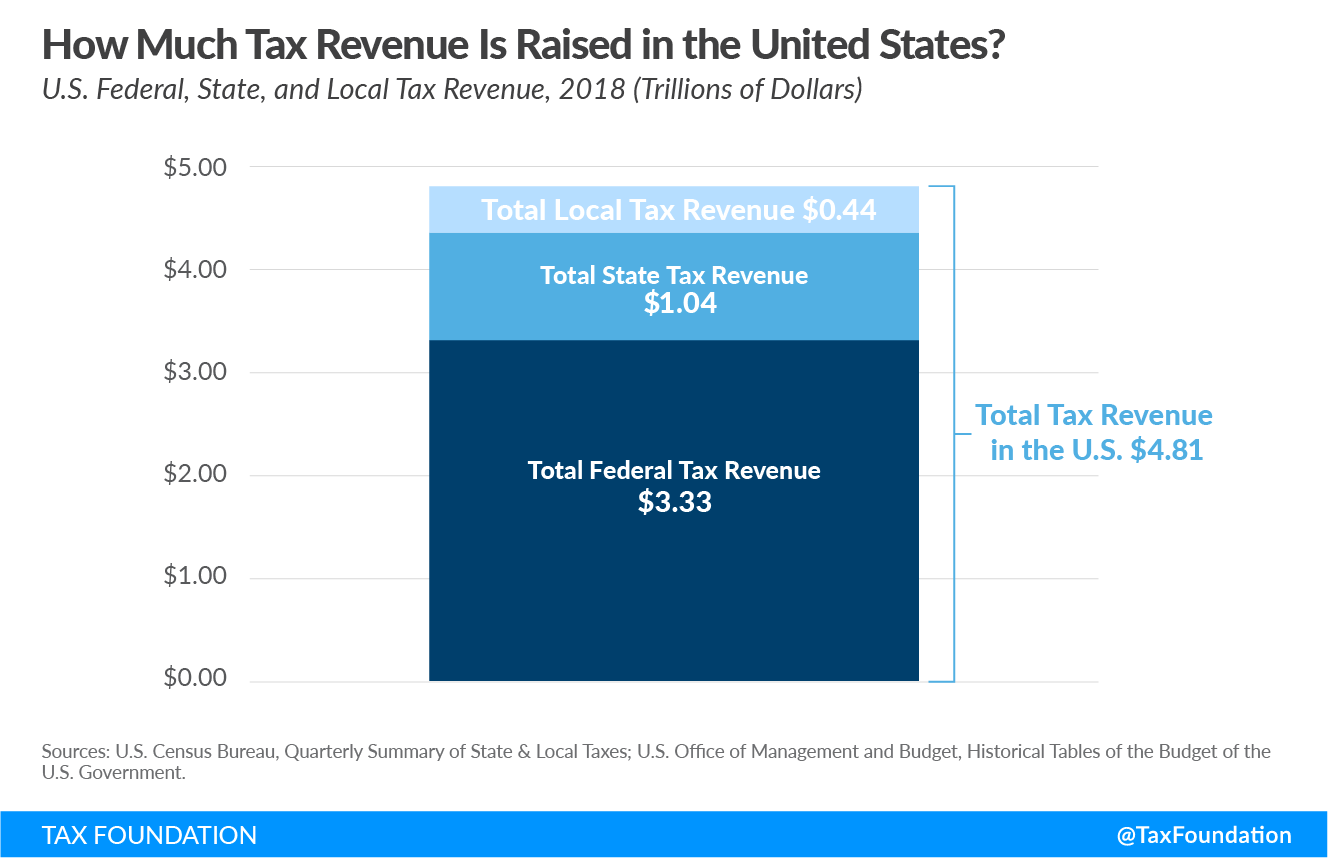

Government Revenue Taxes Are The Price We Pay For Government

Government Revenue Taxes Are The Price We Pay For Government

Simple Strategies To Save Your Business Money Small Business Sarah Business Money Best Small Business Ideas Promote Small Business

Free Tax Prep Checklist Packet Mom For All Seasons Tax Prep Tax Prep Checklist Homeschool Freebies

Government Revenue Taxes Are The Price We Pay For Government